6 days ago

Intent-Based Bridging for Seamless UX with Across on Gelato RaaS

This article is part of the Gelato RaaS Interop Series. Read more:

This article is part of the Gelato RaaS Interop Series. Read more:

Overview (TL;DR)

- Multichain transfers need to prioritize user experience. Across Protocol's intent-based architecture enables users to express outcomes rather than manage complex processes.

- Solvers should protect users from finality risks. Across's relayer network fronts capital to deliver 2-second transfers.

- Canonical assets are essential for L2 Rollups to inherit L1 security. Across exclusively uses native tokens to eliminate the security vulnerabilities that have led to major bridge hacks.

- Optimistic verification enables efficient settlement. Unlike per-message verification, Across's optimistic model with UMA oracles allows for batch processing of transactions at reduced cost—from O(n) to O(1).

- Standards drive ecosystem-wide adoption. ERC-7683, co-authored by Across and Uniswap Labs, creates a unified framework for crosschain intents.

- Intents and native interoperability can work together. Optimism's adoption of Across alongside its Superchain native interop shows how these approaches complement each other.

- Interop infrastructure is best when tailored for each asset type and use case. Across excels in high-TVL EVM environments and can quickly bring liquidity of widely-used tokens to new chains.

Across: Pioneering the Intent Revolution

In late 2021 Across Protocol pioneered intents, a totally new approach to crosschain asset bridging. Intents protocols flip the bridging paradigm by focusing on user outcomes rather than execution mechanics. Instead of forcing users to navigate complex bridging processes, intents allow them to simply express what they want to achieve, with solvers handling the execution.

In late 2021 Across Protocol pioneered intents, a totally new approach to crosschain asset bridging. Intents protocols flip the bridging paradigm by focusing on user outcomes rather than execution mechanics. Instead of forcing users to navigate complex bridging processes, intents allow them to simply express what they want to achieve, with solvers handling the execution.

Note: Throughout this article, we'll use the term "solvers" when referring to Across “relayers” or “fillers,” as it's the more common term in the broader intent ecosystem, though these terms are used interchangeably when discussing Across Protocol.

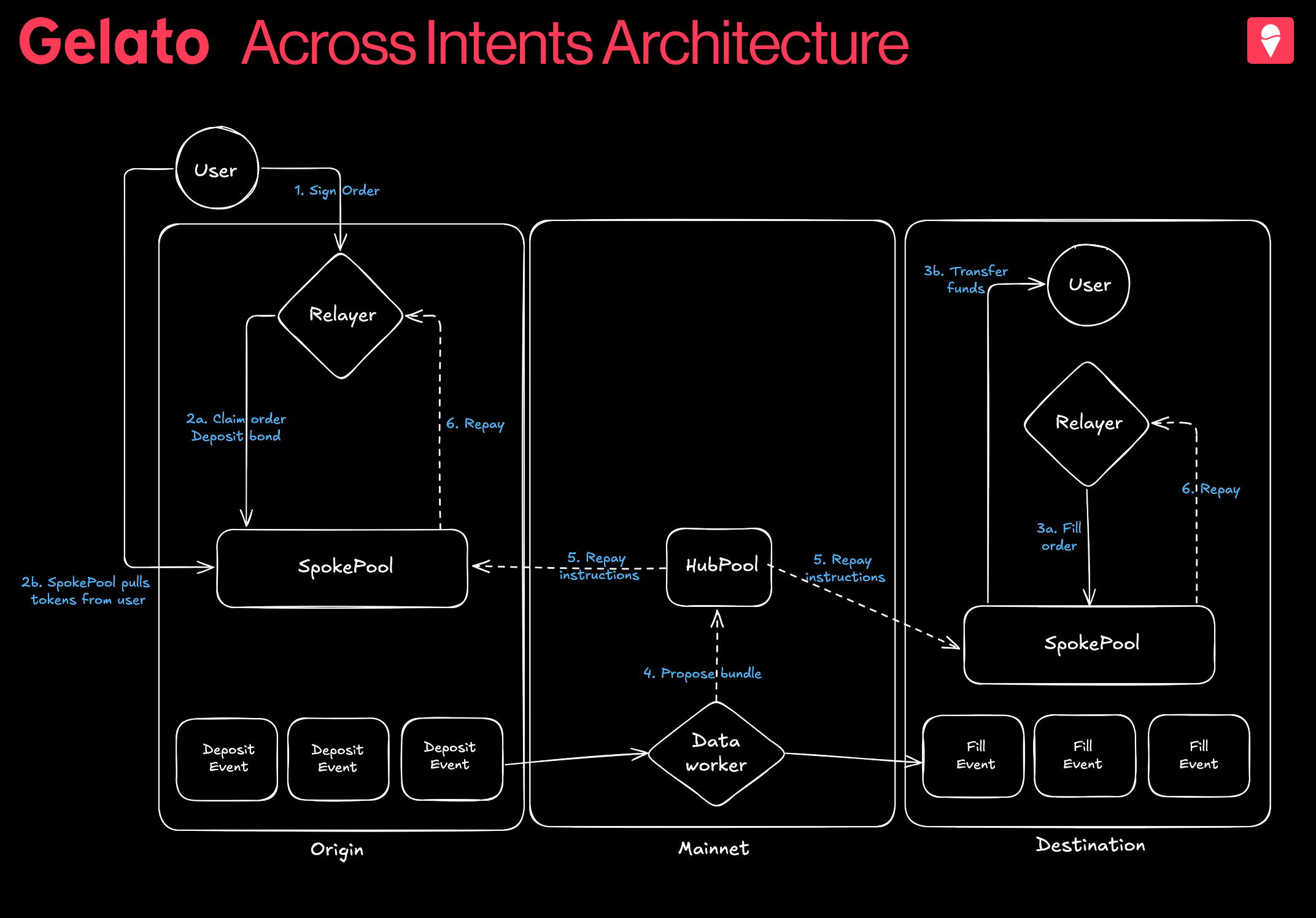

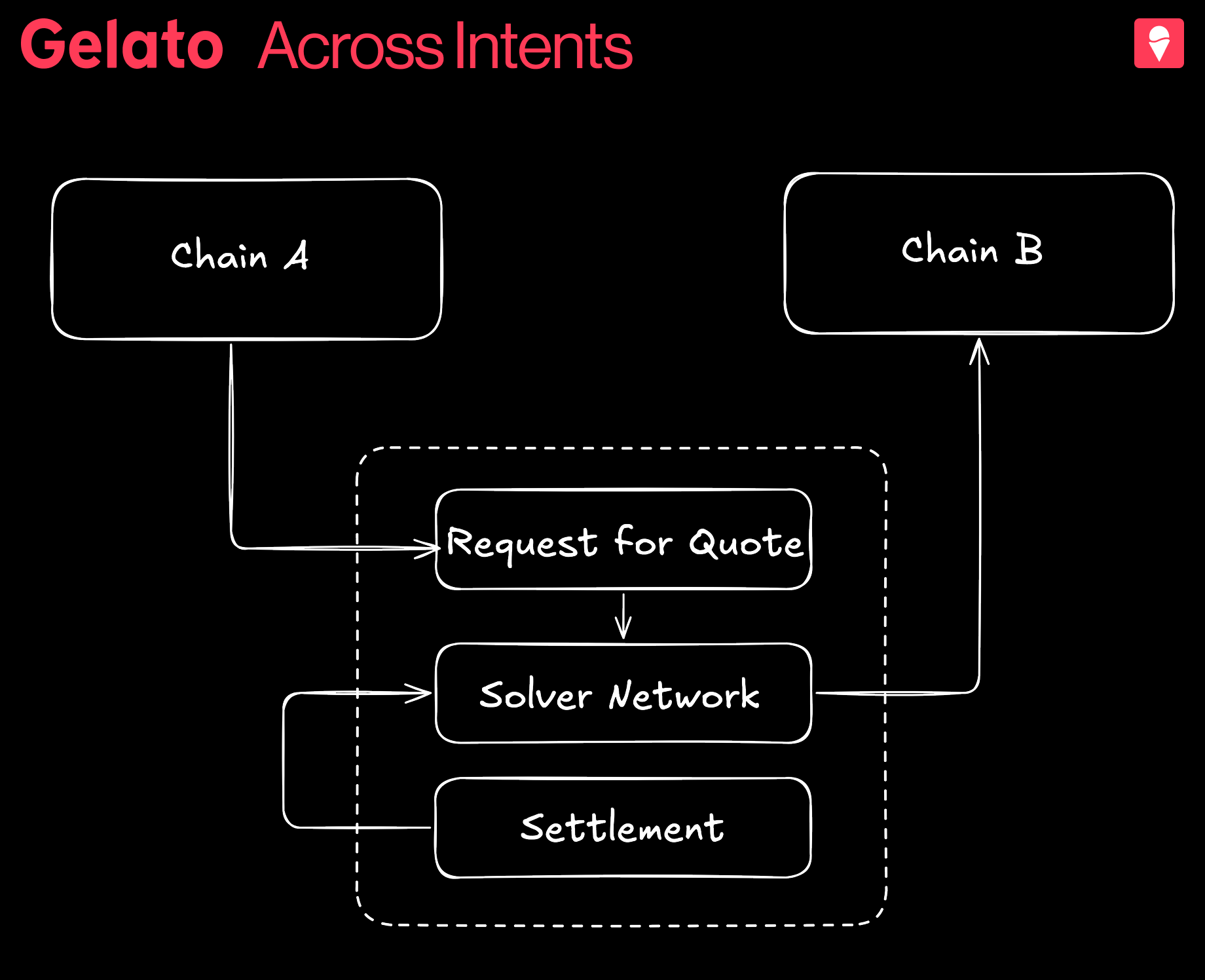

Across' system consists of three key layers:

- Intents Layer - Where users express their desired outcome (e.g., "Send ETH from Ethereum to Base")

- Relayers - Solvers fulfill batches of intents by fronting capital

- Settlement Layer - Solvers are repaid through optimistic verification

The process works like this:

- Users express their intent through a simple interface

- Across Relayers compete to fulfill this intent, delivering funds in as little as 2 seconds

- The winning solver fronts their own capital to fulfill the request

- Behind the scenes, the solver is later reimbursed through Across' settlement layer, which uses UMA's Optimistic Oracle (OO) for verification

The brilliance of this approach is that it shifts complexity away from users. Solvers assume finality risk and front capital in exchange for modest fees, while users enjoy a fast, simple experience and the security of canonical tokens.

The Optimistic Verification Model

Across' settlement layer uses an optimistic verification system powered by UMA's Optimistic Oracle (OO) to ensure security and efficiency in the repayment process.

Across' settlement layer uses an optimistic verification system powered by UMA's Optimistic Oracle (OO) to ensure security and efficiency in the repayment process.

The protocol aggregates transactions during one-hour windows, which allows for significant cost amortization that transforms what was previously an O(n) cost problem into an O(1) operation. This means users pay substantially lower fees because the gas costs for settlement are spread across all users in the batch rather than being borne individually.

Here's how the optimistic model works:

- Batched Proposal: Every hour, a dataworker aggregates all fulfilled intents across chains and creates a merkle root representing these transactions.

- Bond and Challenge Period: The merkle root is proposed to the UMA Optimistic Oracle with a bond. It then enters a challenge period (currently set to 60 minutes) during which anyone can dispute the validity of the proposal.

- Dispute Resolution: If a dispute occurs, UMA token holders vote to determine the correct outcome. This system only requires a single honest participant to identify and flag fraudulent activity.

- Settlement Execution: If no disputes arise during the challenge period, the settlement is considered valid, and the system processes the batch repayment to all solvers who fulfilled intents during that period.

From the user's perspective, there is a very small risk window if a solver fails to deliver funds after claiming an order was fulfilled. In such cases, Across' protocol allows for disputes to be raised, and the UMA oracle system would arbitrate to ensure users either receive their funds or have their original deposits returned. If there is no dispute, the assertion is optimistically treated as correct. In the overwhelming majority of cases where solvers perform as expected (delivering funds within seconds), once users have their funds, they don’t need to worry about what the settlement process looks like for the solver. The dispute mechanism serves as a safety net that only activates if a dispute is raised. Analysing the risk profile of Across’s UMA oracle dispute resolution mechanism by token votes is beyond the scope of this article.

Liquidity Management

Effective liquidity management is one of the biggest challenges for making an intent protocol work. Without sufficient liquidity across chains, even the most elegant intent-based system will struggle to provide a reliable service.

Solver-Driven Liquidity

Across relies on a competitive network of solvers who provide liquidity across supported chains and fulfill user intents, earning fees in return. This is a market-driven approach to liquidity allocation, with solvers incentivized to provide capital where demand is highest.

What’s a Solver?

Solvers are specialized entities that monitor user intents and compete to fulfill them by fronting their own capital. Major participants in Across' solver network include professional market makers and DeFi-native teams who maintain liquidity across multiple chains. Across maintains a permissionless network open to qualified participants.

Solvers are specialized entities that monitor user intents and compete to fulfill them by fronting their own capital. Major participants in Across' solver network include professional market makers and DeFi-native teams who maintain liquidity across multiple chains. Across maintains a permissionless network open to qualified participants.

In the Across model, users gain access to their capital on the other chain as soon as possible, which means solvers take on the risk when they front their capital to fulfill user intents. This model has proven extremely effective for ETH and major stablecoins and other high-volume tokens, because solver competition drives down costs for users and maintains fast transaction times.

Solvers can use traditional bridges to rebalance their positions, including canonical rollup bridges, Circle's CCTP, and other infrastructure. This flexibility allows them to maintain optimal liquidity across different chains while minimizing their own capital requirements.

Canonical Assets: The Security Foundation

Across exclusively uses canonical or native assets. This approach is a huge way Across reduces risk, as users always receive native tokens rather than wrapped or synthetic versions.

When a user bridges 1 ETH from Ethereum to Base via Across, they receive 1 ETH on Base—not a wrapped representation thereof. Canonical asset maximalism eliminates entire classes of security risks associated with representative tokens, which have been at the center of most major bridge hacks.

It's important to understand that while users rely on solvers to deliver their funds promptly, they also have safeguards through UMA's optimistic oracle that can resolve disputes if a solver fails to deliver. It has to be stated, therefore, that whilst in transit the users’ assets are secured by Across’s UMA oracle-based crosschain verification fallback mechanism, and not the L2 canonical bridge security. However, once users receive their canonical assets on the destination chain, they enjoy the full security of that chain's canonical token. There's no ongoing vulnerability from holding a wrapped asset that could be compromised through bridge exploits after the cross-chain transfer is complete, as would be the case for LayerZero OFTs, for instance.

ERC-7683: Standardizing Crosschain Intents

As intent-based approaches gained traction, Across recognized the need for standardization to prevent ecosystem fragmentation. Working with Uniswap Labs, Across co-authored ERC-7683—a universal standard for crosschain intents.

As intent-based approaches gained traction, Across recognized the need for standardization to prevent ecosystem fragmentation. Working with Uniswap Labs, Across co-authored ERC-7683—a universal standard for crosschain intents.

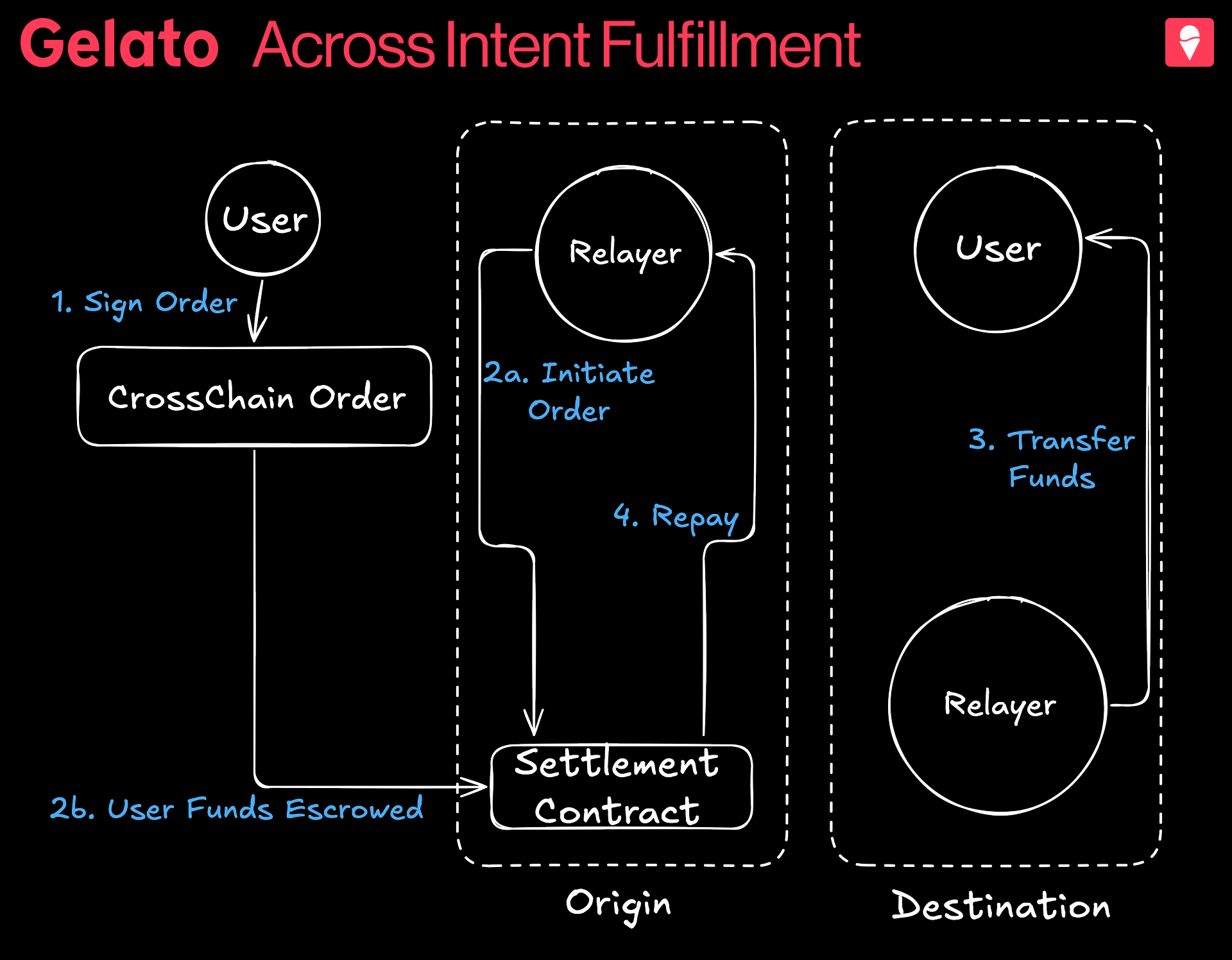

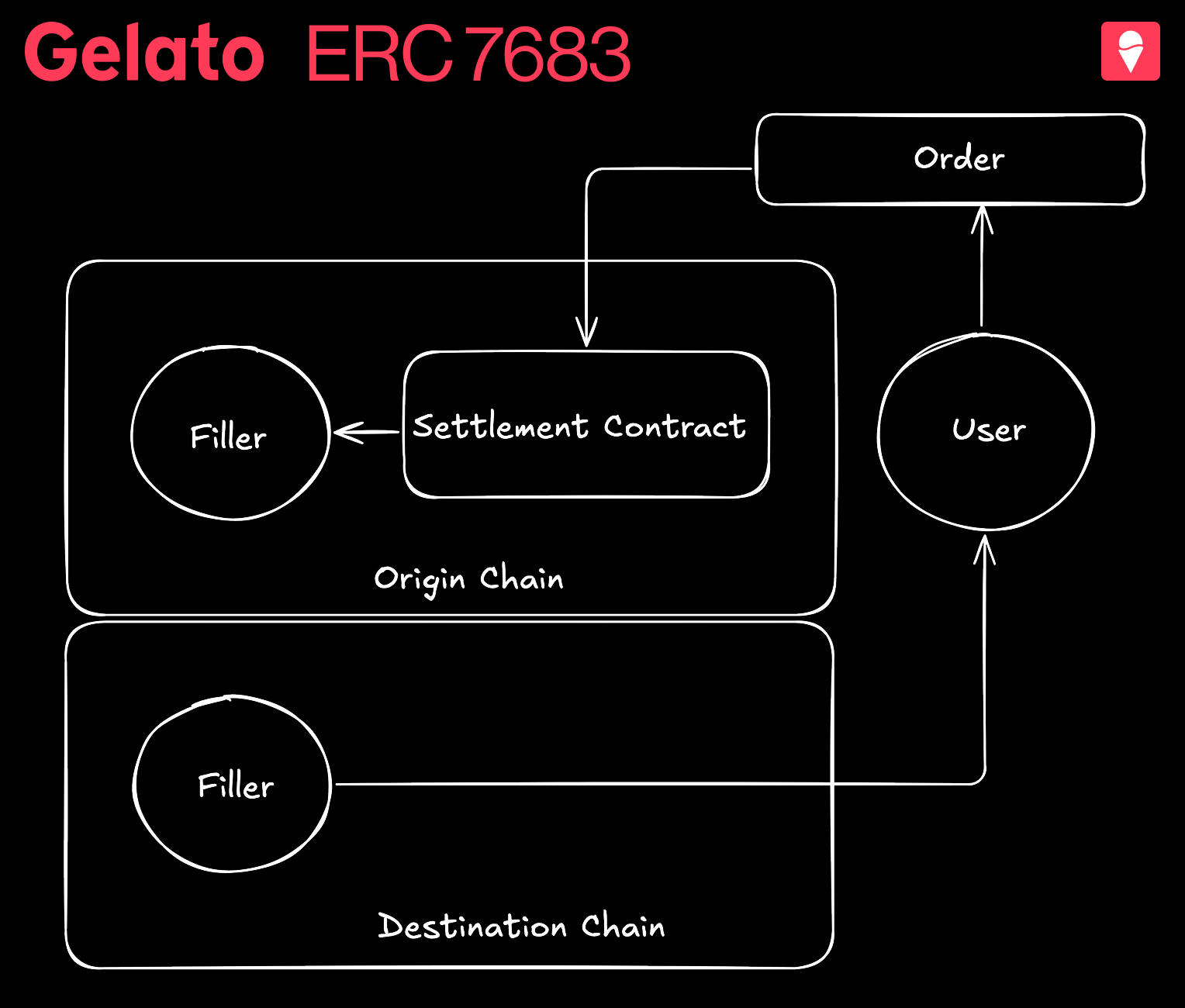

Without standardization, if each protocol had its own intents implementation, it would lead to fragmentation, centralization risks, and delays due to the limited number of solvers serving each isolated protocol. ERC-7683 enables solvers to be protocol-agnostic. ERC-7683 standardizes how crosschain intents are expressed and executed, defining two key components:

- CrossChainOrder: Contains settlement details, deadlines, and message data

- CrossChainSettler: Provides the interface for initiating and resolving orders

This standard creates a common framework for developers to build crosschain experiences, allowing users to enjoy consistent interactions across different applications while enabling relayers to serve multiple protocols efficiently.

With support from over 70 major projects including Arbitrum, Base, Optimism, Polygon, and ZKsync, ERC-7683 is quickly becoming the foundation for a unified Ethereum ecosystem.

This standardization creates powerful network effects. With a shared solver pool across multiple platforms, more competition leads to better execution, which attracts more users, which in turn attracts more solvers. This benefits users through lower fees but shifts value away from solvers toward both the platforms that originate order flow and the settlement networks that provide crucial infrastructure. Highly performant solvers perform an incredibly valuable service to the ecosystem in this model, and are likely to play an even bigger role in the future, although they will be faced with increased competition and a need to stay revenue-positive.

Major Integrations and Ecosystem Impact

Uniswap Integration

Uniswap Labs has integrated Across as its intents provider, enabling users to transfer assets across 9 EVM chains directly within the Uniswap interface and wallet. True to design, nothing additional is required from the user to take advantage of this integration, which paired the most established DeFi application with the leading intents provider for seamless crosschain functionality.

Optimism Superchain

In addition to developing its own native interoperability solution, Optimism has recognized the value of Across' intent-based approach, and has integrated Across to power fast transfers on its Superchain through Brid.gg and Superbridge interfaces. This shows yet again how intent protocols and native interoperability can complement each other.

Kraken's Ink L2

Across launched as the day-one bridge for Kraken's Gelato RaaS-supported Ink L2, powering fast, secure transfers between Ink and the broader Ethereum ecosystem. With this integration, Across shows how it can easily bootstrap liquidity for new L2s and connect them with existing networks from launch.

Expanding Network

With over 40 dApps integrated and 16+ EVM chains supported, Across has processed more than $20 billion in bridging volume. The protocol currently supports ETH, WETH, USDC, USDT, and DAI transfers across all major EVM networks.

Across offers three key intent-based products:

- Bridge app: End-user bridge for quick, cheap, secure transfers

- Bridge SDK: Integration tools that allow users to onboard assets without leaving your app or abstract bridging completely

- Settlement Layer: Powers use cases that require customization beyond Across Bridge integration (e.g., cross-chain token swaps)

Intent-Driven Interoperability with Gelato RaaS

By focusing on what users want to accomplish rather than how to accomplish it, Across Protocol's intent-based architecture provides a vastly more streamlined user experience for crosschain interoperability, and is particularly effective for high-TVL chains and widely-used assets like ETH and major stablecoins.

For L2 rollups with significant liquidity and established ecosystems, Across provides an ideal solution through its competitive solver network and optimistic verification model. Projects like Kraken's Ink and Lisk have already leveraged this integration through Gelato RaaS to offer their users day-one access to Across's proven bridging infrastructure.

For emerging chains that aren't L2s, or for more exotic tokens with specialized requirements, alternatives like LayerZero's OFTs or Hyperlane's modular messaging may offer advantages. Each solution makes different trade-offs between security, speed, and functionality to address specific use cases.

Deploy Your Rollup with Across Support

Deploy your own chain on Gelato RaaS with built-in support for Across' intent-based bridging. Your rollup can tap into Across' established solver network to give your users immediate access to fast, secure transfers of ETH and major stablecoins across the entire Ethereum ecosystem.

Ready to deploy your own chain with built-in support for cross-chain intents? Visit gelato.network/raas today to explore your options.